‘Improvident’: Lacking foresight; spendthrift; failing to provide for the future.

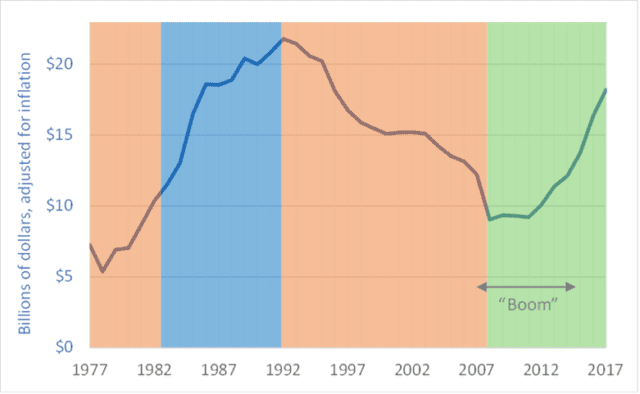

This week’s graph shows total Saskatchewan government debt, adjusted for inflation, for the period 1977 to 2017. The coloured shading indicates the political party in power at the time: orange for New Democratic Party, blue for the Conservative Party, and green for the Saskatchewan Party.

From 2007 to 2015, Saskatchewan experienced an economic boom. In 2007 and ’08, commodity values spiked and pushed up the prices of potash, uranium, oil, natural gas, lumber, and grains and oilseeds. Provincial gross domestic product (GDP) rose sharply. Even after the financial problems of 2008, a revival in energy prices and energy-sector expansion in this province and neighboring Alberta kept demand for employees strong and wages high (for many workers, though not all). Since the boom began, housing prices in Saskatchewan have nearly doubled. Saskatchewan went from being a have-not province to a prosperous and swaggering economic leader.

As resource royalties rose and taxable incomes and sales increased, provincial tax inflows initially swelled. One could imagine that the provincial government would take advantage of these windfalls to pay down Saskatchewan’s debt. The government did not. Instead, it cut taxes and embarked on several ill-conceived spending projects. Corporate income taxes in Saskatchewan are now, according to the government, the lowest in the country (source here). As the graph shows, after 16 years of paying down the debt (1992-2008), that pay-down ended in 2009, just as the Saskatchewan economy was heating up.

Initially, provincial debt levels stayed relatively constant as the boom proceeded, but debt began increasing in 2012. Since then, Saskatchewan’s provincial government debt has doubled, with much of the increase racked up before the economic good times ended. Even as the economy was prospering the government was borrowing money.

Having squandered its chance to pay down debt, save for a rainy day, or build up a financial cushion, the Saskatchewan government came to the end of the economic upturn only to find itself in an increasingly dire financial situation. In its most recent budget, the province took several draconian steps to try to control its self-inflicted deficits and restrain its ballooning debt. The government:

– shut down the province’s bus company;

– cut transfers to cities;

– reduced funding to libraries;

– eliminated funding for home repairs for people on social assistance;

– reduced wages for civil servants;

– cut subsidized podiatry services (creating a risk of increased foot amputations for diabetics and others);

– cut subsidies for hearing aids for children; and

– eliminated funding to pay for funerals for its poorest citizens.

Projections by the provincial government show that by 2020 the province’s debt will return to levels not seen since 1992. In that year, provincial government cabinet ministers were forced to fly to New York City to meet with bond-rating agencies to prevent those agencies from downgrading provincial debt to “junk” status. The specter of a return to those levels of debt shows that the government of Saskatchewan truly bungled the boom.

Graph sources: data obtained by request from the Economic & Fiscal Policy Branch of Saskatchewan’s Ministry of Finance