On April 20, 2017, the Manitoba Co-operator published my editorial outlining a positive model of a carbon tax on farmers and agriculture. An agricultural carbon tax can reduce emissions and increase incomes.

Click here to download a PDF copy.

Author, civilizational critic, long-term thinker, researcher, speaker

On April 20, 2017, the Manitoba Co-operator published my editorial outlining a positive model of a carbon tax on farmers and agriculture. An agricultural carbon tax can reduce emissions and increase incomes.

Not every problem has a clear solution. Here’s one that does. The problem is the exponential growth in air travel and attendant greenhouse gas (GHG) emissions. The solution is high-speed passenger rail.

Compared to airplanes, high-speed trains can move people faster, more comfortably and conveniently, more cheaply, and with a fraction of the GHG emissions. And Canada is uniquely placed to benefit from a passenger-rail renaissance; one of the world’s largest passenger-rail manufacturers, Bombardier, is a Canadian company.

Air travel is increasing exponentially. As I detailed in a previous blog post, air travelers now rack up about 7 trillion passenger-kilometres per year. And that figure is projected to double by 2030. If we are to retain a tolerable climate, most of the planes will soon need to be grounded, excepting perhaps those used for trans-oceanic flights.

While airplanes may remain our best option for crossing oceans, within continents higher-speed rail (130–200 km/h) and high-speed rail (200+ km/h) can move people faster and more comfortably. Such trains can transport passengers from city-centre to city-centre, eliminating the long drive to the airport. Trains do not require time-consuming, invasive airport security screenings. These factors, combined with high speeds, mean that for many trips, the total travel time is lower for trains than for planes. And because trains have much more leg-room and often include observation cars, restaurants, and lounges, they are much more comfortable and enjoyable.

Many people will know the Eurostar high-speed line that connects Paris and other European cities to London via the Channel Tunnel. Top speed for that train is 320 km/h. A trip from downtown London to Downtown Paris—nearly 500 kms—takes 2 hours and 20 minutes, about the time it takes the average North American to drive to the airport, check in, check baggage, clear security, and get to his or her airplane seat.

China recently inaugurated its Shanghai Maglev line, with a maximum speed of 430km/h and average speed of 250 km/h. Japan’s famous “bullet trains” went into service more than 50 years ago. They now travel on a network of 2,764 kms of track and reach speeds of 320 km/h.

North America has one high-speed line, the Acela Express that links Boston, New York, Philadelphia, Baltimore, and Washington. The maximum speed is 240 km/h, through average speeds are lower. Travel time from New York to Washington is 2 hours and 45 minutes, including time spent at intermediate stops: an average speed of 132 km/h. The Acela Express trains were built by a consortium 75 percent owned by Canada’s Bombardier.

This brings us to the truly good news: Canada is home to a world-leading passenger rail manufacturer, Bombardier. You will find the company’s rolling stock in the subways of New York, London, and more than a dozen other cities. Its intercity trains run throughout Europe, Asia, and North America. And its high-speed trains are currently moving passengers in China, Europe, and the US. Until a recent merger of two Chinese companies, Canada’s Bombardier was the largest passenger train manufacturer in the world. Canada has a huge opportunity to create jobs and economic activity while leading the world in low-emission, cutting-edge rail technology. As climate change forces Canada to scale back fossil-fuel production and maybe even auto manufacturing, Canada will need new economic engines. Passenger-rail manufacturing can be an economic engine of the future.

Not all the news is good, however. Many will have recent heard news reports about Bombardier. Over the past few years, Federal and provincial governments have provided cash injections to the company totaling more than a billion dollars, largely to cover costs on its C-Series passenger-jet program. Bombardier is in trouble. Indeed, it may have made one of the biggest business blunders in recent decades: financially imperiling a world-leading train maker to make a huge gamble on planes just as climate change forces us to ground the planes and build a trillion-dollar passenger rail system. Bombardier has recently announced that it may merge its train division with the German company Siemens.

Bombardier has been foolish. Canadian citizens and their governments have been equally foolish: handing over billions of taxpayer dollars and not receiving a single passenger train in return. But we can be smart. That means building a North American network of fast trains. Bombardier can prosper by being one of the main suppliers for that network. High-speed passenger rail can be a win-win-win: jobs for Canadians and Americans; fast, comfortable travel; and a high-tech, low-emission transportation system on this continent like the ones being built in Europe and Asia.

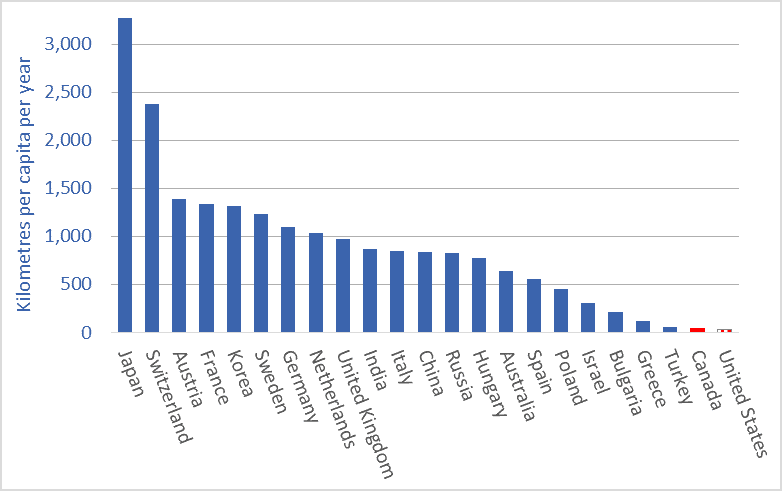

The graph at the top of this article shows average per-person passenger-train utilization. The data is from the most recent year available: 2014 or ’15. Passenger rail utilization rates in Canada and the US (an average of less than 40 kms per person per year) are among the lowest in the world. In China, average use is more than 800 kms per person per year and rising very rapidly. In many European nations, it is more than 1,000 kms per year per person—25 to 30 times the Canadian and US rates. There is huge growth potential for the passenger rail sector in North America.

Graph sources: OECD.

Fractal collapse is an important, useful idea. It helps us understand that a society, economy, political system, or civilization may not “fall,” but rather become pock-marked and weakened—shot through with micro-collapses.

The United States may be in an advanced state of collapse. There are many indicators that this is the case. The national debt, nearly $20 trillion, about a quarter-million dollars per family of four (see my “US national debt per family”), seems unrepayable. America’s former industrial heartland is now mostly rustbelt, and parts of Detroit look like sets for “Walking Dead” or “The Road.” Climate change is bearing down from one side and resource depletion from another. Its democratic system—rotted by dark money, voter suppression, gerrymandering, the distortions of the Electoral College, and messianic populist politics—has delivered gridlock, ideologues, cartoon-level analyses of complex issues, and, now, Trump. Many of the manufacturing jobs that have not moved to Asia may soon be taken by robots. Inequality and incarceration-rates are at record highs. One could extend this list to fill pages.

Despite the preceding, I’m not predicting that America (or Greece or Australia or England) will “fall”—pitch into rapid and irreversible economic contraction and social disintegration. Instead, fractal collapse is more likely. In fractal collapse, parts of a system fail, at various scales, but the system, in diminished form, carries on. We’re seeing this in America. We see the collapse of a household here (perhaps a result of the opioid crisis), and a neighbourhood, there; a city declines rapidly (think Detroit or Scranton) and a county declares bankruptcy. Collapse occurs in various places and at various scales but the aggregate entity moves forward. And such collapses are not predictable—they do not just happen to poor people or in the “poor” places. Suddenly and unexpectedly, the investment banks collapse, then General Motors becomes insolvent. The Senate and House of Representatives cease to function properly. Collapse is not a single event. As we are seeing it play out now—amid the hyper-energized and dominant “industrial” economies—collapse is multiple, iterative, and repeated across scales: it is fractal.

And collapse is not monolithic or pervasive. Indeed, some parts of the system expand and prosper. The US is manufacturing billionaires at a record pace, the stock market continues to climb, output of everything from corn to natural gas is up, and Google and Apple are world-leading corporations. A hallmark of collapse is that societies become dis-integrated, allowing some parts to fall as other parts rise.

The image above is a Sierpinski triangle or “gasket.” It helps visualize this idea of fractal collapse. Step by step, the original triangle shape develops more holes and loses area, but it does not disappear. its outlines remain apparent.

To make a Sierpinski gasket, we start with an equilateral triangle. Then we identify the mid-points of each side and use these as the vertices of a new triangle, which we remove from the original. (See the top-middle triangle, above.) This leaves us with three equilateral triangles. We repeat this process over and over; we iterate. From each remaining triangle we remove the middle, leaving three smaller triangles. The Sierpinski gasket and its repeated holing can serve as a visual metaphor for the fractal collapse that may now be hollowing out many of the world’s nations.

The future is not binary, not rise or fall. Increasingly, nations may become less homogeneous. Some parts may expand and prosper while other parts may wither or fail. The overall trendline may not be upward, however, but rather downward. Our future may not be a train wreck, but rather a slow dilapidation. Not with a bang but a wimper. We can change this outcome. But currently very few are trying.

The intellectual history of the idea of fractal collapse is not wholly clear. The concept came out of the physical sciences and has been popularized as a description of social and economic collapse by author and analyst John Michael Greer.

Global production of transistors has surpassed 20 trillion per second—hundreds of quintillions per year. Transistors are the primary building blocks of modern electronic devices: computers, smartphones, TVs, radios, and other devices. Transistors use semiconductor materials to amplify (think transistor radios) or switch (think digital computers) electronic signals and electrical power. Transistors can be individual components, but are found in far greater numbers embedded in integrated circuits—in computer “chips.”

The graph above shows global production of transistors per year per person. Per capita values are used here to make the size of the numbers more manageable. In 1955, production was one transistor per 1,000 people—essentially zero. Radios and TVs in the mid-’50s used vacuum tubes rather than transistors and integrated circuits.

Just ten years later, in 1965, production had increased 1,000-fold, to one transistor per person per year. Transistor radios were gaining popularity in the 1960s. Each radio contained several transistors—often 5 to 10.

While production in 1965 was one transistor per person per year, by 1975 it was nearly 1,500 per person. Individual transistor components had been replaced by semiconductor computer chips, each containing thousands or millions of individual transistors.

The 1980s saw the proliferation of computers and home electronics. By 1985 global production of transistors had surpassed 40 thousand per person per year. By 2000 it was 65 million. Today it is 56 billion per person.

The world now produces more transistors in one second that it did in one year in 1980.

The global population could not afford to purchase, on average, 56 billion transistors per person per year if prices had remained at 1965 or 1985 levels. In the latter-1950s, a transistor radio with 5 transistors cost nearly $500 in today’s dollars. Now, for not much more money, you can buy an iPhone that contains hundreds of billions of transistors.

A pound of rice sells for approximately one dollar and contains about 25,000 grains. For that same dollar you can buy—as part of a memory stick or a phone—not 25,000 transistors, but billions. A transistor today is thousands of times cheaper than a grain of rice.

Much of the news about the world is negative: famine, genocide, fisheries collapse, climate change, extinctions, resource depletion. But we also need to acknowledge that our global hyper-civilization is truly wondrous. We have built human systems of nearly incomprehensible power and productivity. This is both their great strength and their great peril. Nonetheless, if we are to safeguard some version of this civilization into the future we must appreciate and value it, despite its profound flaws. We must take the time to understand it. And we must work together to reform it.

Graph sources: VLSI Research. Note that values are approximate and were derived, not directly from data, but from an existing graph. Thus, while overall trends and conclusions are robust, individual values for specific years are approximate.

When I was in grade-school, an uncle taught me something about limits, and about doubling. He asked me: How many times can you fold a piece of paper in half? Before I could reply, he told me that the answer was eight. I thought this seemed too low. So, as a child eager to demonstrate adults’ errors, I located a sheet of writing paper and began folding. I managed seven folds—not even achieving the predicted eight. I thought that the problem was the small size of the paper. So, I located a newspaper, removed one sheet, and began folding. I folded it eight times but could not make it to nine.

Why this limit? Most people assume that the problem is the size of the sheet of paper: as we fold it, the paper gets smaller and, thus, the next fold becomes harder. This is true, but the real problem is that the number of sheets to be folded increases exponentially. Fold the paper once and it is two sheets thick. A second fold brings the thickness to four sheets. A third fold: eight. A fourth, fifth, and sixth fold: sixteen sheets, thirty-two, then sixty-four. The seventh fold doubles the thickness again to 128 sheets, and an eighth to 256. When I was a child folding that sheet of newspaper, in attempting that ninth fold I was straining to bend 256 sheets.

Now, if I started with a very large piece of paper perhaps I could prove my late uncle wrong and achieve that ninth fold. It’s hard to predict precisely where limits lie. Imagine a football-field-sized piece of paper and ten linebackers assigned the task of folding. Those players could certainly make nine folds. Perhaps they might even achieve ten, bending 512 sheets to increase the thickness to 1,024. Maybe they could strain to make eleven folds, bending those 1,024 sheets to achieve a thickness of 2,048. But eventually the doubling and redoubling would reach a point where it was impossible to double again. Exponential growth creates a doubling problem.

Our petro-industrial-consumer mega-civilization has a doubling problem. During the 20th century we doubled the size of the global economy four times. Four doublings is a sixteenfold increase: 2, 4, 8, 16. Despite this multiplication, today, every banker, CEO, investor, Minister of Finance, shareholder, bondholder, and would-be retiree (i.e., nearly all of us) wants to keep economic growth going. And we want growth to continue at “normal” rates—rates that lead to a doubling in the size of the economy about every 25 years. Thus, in effect, what we want in the 21st century is another four doublings—another sixteenfold increase. The graph above shows the sixteenfold increase that occurred during the 20th century and shows what a sixteenfold increase during the 21st century would look like.

The first doubling of the 21st century is already underway. We’re rapidly moving toward a global economy in 2025 that is twice the size of the one that existed in 2000. But the economy in 2000 was already placing a heavy boot upon the biosphere. By that year, North America’s East Coast cod fishery had already collapsed, greenhouse gas emissions were already driving up temperatures, and the Amazon was shrinking. Despite this, we seem to believe that a 2025 economy twice as large as that year-2000 economy is “sustainable.” Even worse, in 2025, we won’t be “sustaining” that two-times-2000 economy, we’ll be working to double it again.

Clearly, at some point, this has to stop. Even those who think that the Earth can support and withstand a human economy twice the size that existed in 2000 must begin to have doubts about an economy four or eight times as large. There can be no dispute that economic growth must end. Though we may disagree as to when.

Perceptive readers will have noted a shortcoming in my paper-folding analogy: That system runs into hard limits; at some point, attempts to double the number of sheets simply fail, and that failure is immediately apparent. Our civilizational-biospheric system is different. Limits to Earth’s capacities to provision the human economy and absorb its wastes certainly exist, but they are not hard limits. Given the immense power of our economy and technologies, we can breach Earth’s limits, at least for a time. On many fronts we already have. It will only be in hindsight—as ecosystems collapse and species disappear and the biosphere and climate become destabilized, damaged, and hostile—that we will know for sure that we’ve crossed a terrible line. Only then will we know for sure that at some point in our past our doubling proceeded too far. So, unlike paper folding, determining the limits of economic growth requires human wisdom and self-restraint.

China’s share of the global economy has increased rapidly—from about 5 percent in the early 1980s to more than 26 percent today. India’s economy has similarly expanded, from 3 percent of the global economy in the early ’80s to more than 8 percent today. Meanwhile, the percentage shares of the US, UK, Germany, Japan, and other nations are falling fast. The graph above shows the relative share of global GDP represented by selected nations. The time-frame is 1000 AD to 2016.

Manufacturing data* similarly shows India and China’s long-term dominance. In 1800, fully half the manufacturing output of the world came from India and China. In that year, the UK contributed 4.3 percent of manufacturing output and the US just 0.8 percent. The UK and US came to dominate global manufacturing by the late-1800s, but their rise is recent and, as the graph above suggests, their dominance may be shortlived.

Many people have been surprised by the “rise of China” and that of India. No one should be. The global economy is merely returning to its long-term normal—resetting after an anomalous period when European and New World nations were economically ascendant. Indeed, England and Europe have been economic backwaters for 97 percent of the time since civilizations first arose 5,000 years ago. Our educational system fails to teach us that China and India are the default global superpowers.

To give just two final examples of the long-term dominance of Asia, China smelted hundreds of thousands of tons of iron in the 11th century using coal rather than wood, a feat not matched in Europe until 600 years later.** A list of the ten largest cities in the world in the year 1500 includes four in China (Beijing, Nanjing, Hangzhou, and Guangzhou) and two in India (Gaur and Vijayanagara), but just one in Europe, (Paris). The three cities rounding off the top-ten list were Tabriz, Cairo, and Istanbul.*** Clearly, the economic and civilizational centre of gravity was in the East. It appears to be shifting back there.

* Paul Bairoch, “International Industrial Levels from 1750 to 1980”

** Hartwell, various pubs

*** Hohenberg, Oxford Encyclopaedia of Economic History

Graph sources: 1000AD-2008, Angus Maddison, 2009-2016 Conference Board

Global freight transport now exceeds 122 trillion tonne-kilometres* per year. That enormous tonnage/distance has more than tripled since the beginning of the “free trade” era, in the 1980s. And the Organization for Economic Cooperation and Development (OECD) projects that global freight transport tonnage will triple again in the coming generation—rising to 330 trillion tonne-kilometres per year by 2050 (see OECD). To put these trillions into perspective, freight movement will soon surpass 100,000 tonne-kilometres per capita per year for those of us living high-consumption lifestyles, here and around the world.

*Note: a tonne-kilometre is equivalent to moving one tonne one kilometre. If you move 10 tonnes 10 kilometres, that is 100 tonne-kilometres.

A major part of this increase in transport tonnage is related to trade agreements and globalization. As we’ve restructured the global economy we have off-shored our factories. Our washing machines, toasters, rubber boots, TVs, and many of our cars now come from half-way around the world. Our foods and fertilizers are increasingly shipped across continents or oceans. And we ship food, resources, and other goods around the world. Economic growth means we’re consuming more and more; globalization means we’re consuming resources and products from further away. These two trends, together, help explain the tenfold increase in global freight transport depicted in the graph.

Moving this colossal tonnage requires ships, trains, trucks, and airplanes—all of which burn fossil fuels and emit greenhouse gas (GHG) emissions. Emissions from the freight transport sector make up about 10 percent of all man-made CO2 emissions (see OECD). The OECD predicts that if current trends and policies hold, emissions will nearly double by 2050, to 5.7 billion tonnes of CO2 per year (see OECD). This near-doubling of freight transport emissions between now and 2050 will occur at the same time that we are attempting to cut overall GHG emissions by half. It is time to ask the obvious questions: Is our ongoing drive toward globalization (i.e., de-localization and transport maximization) compatible with our emission-reduction commitments and a livable climate? Indeed, as our leaders aggressively sign and implement still more “free trade” agreements (TPP, CETA, etc.) we should consider that perhaps doubling down on globalization vetoes emissions reduction, vetoes a stable climate, vetoes local food, and vetoes local jobs.

Graph sources: 2015, 2030, and 2050 data from the OECD/ITF page 56. Data for 2000 and 1985 are from various sources: air freight data is from the World Bank. Rail freight data is from the World Bank. Maritime freight data is from the United Nations, Review of Maritime Transport. Road freight data for 2000 is from the OECD. Road freight data for 1985 is an informed estimate.

Many corporate spokespeople, government officials, economists, and journalists are repeating a very odd line: “oil prices are low.” Others talk of “cheap oil,” “plunging prices,” and a “crash.” Here’s one example, a 2016 headline from Maclean’s: “Life at $20 a barrel: What the oil crash means for Canada.”

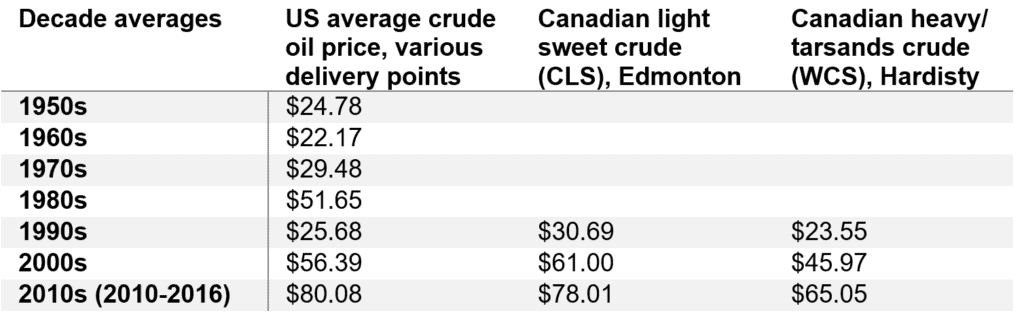

I will argue that talk of “low oil prices” ignores history, misconstrues energy’s role in making civilizations, and confuses our efforts to build resilient, sustainable, climate-stabilizing economies. The graph above and the table below put recent oil prices into their long-term context. The graph covers the 156-year period from the first large-scale production of petroleum oil to the present: 1860 to 2016. It shows US average crude oil prices and Canadian prices for light sweet crude and heavy tarsands crude. For comparability, all figures are in US dollars and adjusted for inflation.

This table helps us interpret the data in the graph by showing average prices for each decade.

Here’s what the graph and table can tell us about current “low oil prices.”

1. The graph shows that the very high 2003-2014 prices are an anomaly.

2. The $80 average price in the 2010s is the highest since the 1870s.

3. Even with recent declines, oil prices remain above the levels that held during the century from 1875 to 1975.

4. While prices have averaged $80 in the 2010s, the average price in the 1950s, ’60s, and ’70s was below $30. The greatest period of economic growth in global history, the postwar US boom, was accomplished with very cheap oil. As the cost of oil goes up, the cost of civilization goes up. If energy prices rise too high, we may no longer be able to afford to continue to build or even maintain our sprawling mega-civilization.

5. Many say that Canadian prices are particularly low relative to US or world prices. That isn’t the case. It’s not that Canadian oil is priced lower than US oil; rather, Canadian heavy (tar sands) oil is priced lower than US and Canadian light oil. The values in the table show this. The graph also shows this in the close correlation of US average oil prices with Canadian light oil prices. The right-wing think-tank The Fraser Institute explains that heavy oil from the tarsands and similar sources is priced lower because such oil “is more costly to transport by pipeline …. Further, the heavier the crude oil …, the lower its value to a refiner as it will either require more processing or yield a higher percentage of lower-valued by-products such as heavy fuel oil. Complex crudes containing more sulphur also generally cost more to refine than low-sulphur crudes. For these reasons, oil refiners are willing to pay more for light, low-sulphur crude oil.”

6. Western Canadians are particularly sensitive to “low oil prices” because our economy is dependent upon some of the highest-cost oil production systems in the world: the tar sands. We are the high-cost producers.

As the International Energy Agency (IEA) said recently, “Attempting to understand how the oil market will look during the next five years is today a task of enormous complexity.” I certainly cannot predict oil prices. And I’m not advocating lower prices. Just the opposite. As someone deeply concerned by climate change, I hope that oil prices rise and stay high, and that governments impose taxes on carbon emissions to push the cost of burning fossil fuels higher still. Nonetheless, we need to dispassionately interpret the data if we are to have any hope of directing our future and our economy. We need to be able to discern when energy prices are low and when they are not.

Graph Sources: Canadian Association of Petroleum Producers (CAPP), Statistical Handbookfor Canada’s Upstream Petroleum Industry (October, 2016); and US Energy Information Administration (EIA), U.S. Crude Oil First Purchase Price

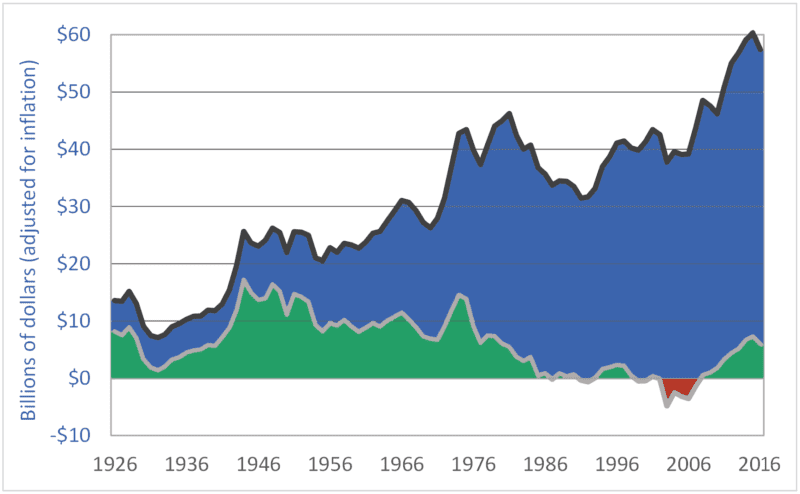

Canadian net farm income remains low, despite a modest recovery during the past decade. In the graph above, the black, upper line is gross farm revenue. The lower, gray line is realized net farm income. Both measures are adjusted for inflation. And, in both cases, taxpayer-funded farm support payments are subtracted out, to remove the masking effects these payments can otherwise create. The graph shows farmers’ revenues and net incomes from the markets.

The green-shaded area highlights periods of positive net farm income; the red-shaded area marks negative net income periods. Most important, however, is the area shaded blue—the area between the gross revenue and net income lines. That area represents farmers’ expenses: the amounts they pay to input manufacturers (Monsanto, Agrium, Deere, Shell, etc.) and service providers (banks, accountants, etc.). Note how the blue area has expanded over time to consume almost all of farmers’ revenues, forcing Canadian net farm income lower and lower.

In the 23 years from 1985 to 2007, inclusive, the dominant agribusiness input suppliers and service providers captured 100 percent of Canadian farm revenues—100 percent! During that period, all of farm families’ household incomes had to come from off-farm employment, taxpayer-funded farm-support programs, asset sales and depreciation, and borrowed money. During that time, farmers produced and sold $870 billion worth of farm products, but expenses (i.e., amounts captured by input manufacturers and service providers) consumed the entire amount.

Bringing these calculations up to date, in the 32-year period from 1985 to 2016, inclusive, agribusiness corporations captured 98 percent of farmers’ revenues—$1.32 trillion out of $1.35 trillion in revenues. These globally dominant transnational corporations have made themselves the primary beneficiaries of the vast food wealth produced on Canadian farms. These companies have extracted almost all the value in the “value chain.” They have left Canadian taxpayers to backfill farm incomes (approximately $100 billion have been transferred to farmers since 1985). And they have left farmers to borrow the rest (farm debt is at a record high–just under $100 billion). The massive extraction of wealth by some of the world’s most powerful corporations is the cause of an ongoing farm income crisis.

To leave a comment, click on the graph or this post’s title and then scroll down.

Graph sources: Statistics Canada, CANSIM matrices, and Statistics Canada, Agricultural Economic Statistics, Catalogue No. 21-603-XPE

This graph shows the global temperature anomaly: how current temperatures compare to latter-twentieth-century “normal” temperatures. Normal, here, is the 1951-1980 average.

in looking at the global temperature data, three things are apparent. First, the Earth is already warming. The graph has been trending strongly upward since at least the 1980s. Second, the increase in temperature from the 1951-1980 baseline period will soon reach one degree Celsius. Indeed, temperature outliers such as those in February and March 2016 are approaching 1.5 degrees. Temperatures are rising fast—charting significant increases in decades, not centuries. Third, there is in the data-points a suggestion that the curve may be getting steeper; temperature increases may be accelerating. It’s too early to tell, but given that global temperature increases are lagging well behind atmospheric greenhouse gas (GHG) increases, and given that global emission rates continue to increase, it is prudent to consider that temperature increases may accelerate beyond already-rapid rates.

How high might temperatures go? Here’s what we know. In the lead-up to the 2015 Paris climate talks, nearly every nation submitted to the United Nations a commitment to reduce GHG emissions. The United States committed to reduce its emissions by 26 to 28 percent (below 2005 levels) by 2025. Canada committed to reduce emissions by 30 percent by 2030. Other nations made comparable commitments. But the climate models show that even if every nation meets its emission-reduction commitments, our Earth will warm this century by 3.2 degrees Celsius—well beyond the so-called “dangerous” level of 2 degrees C, and more than double the 1.5 degree mark discussed in Paris. Indeed, the graph above makes it clear that 1.5 degrees was always pure fiction. In order to avoid a temperature increase of 3.2 degrees, we must set and meet more ambitious targets.

Climate science can be complicated. But at a public policy level—at the levels of citizens and legislators and democratic governance—climate change is simple and clear. It is happening. It is happening fast. And it will devastate our cities, economies, food systems, ecosystems, and perhaps even our civilization unless we act fast. Simple.

Graph sources: Combined Land-Surface Air and Sea-Surface Water Temperature Anomalies from National Aeronautics and Space Administration (NASA) Goddard Institute for Space Studies (GISS): GISS Surface Temperature Analysis (GISTEMP).