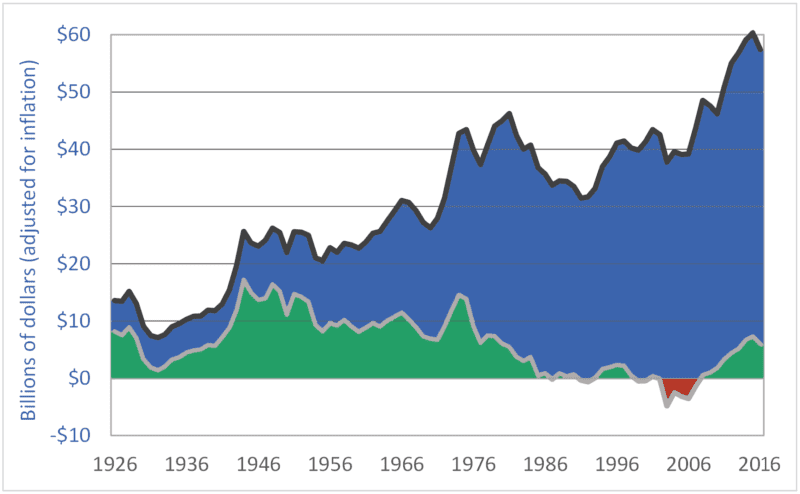

Canadian net farm income remains low, despite a modest recovery during the past decade. In the graph above, the black, upper line is gross farm revenue. The lower, gray line is realized net farm income. Both measures are adjusted for inflation. And, in both cases, taxpayer-funded farm support payments are subtracted out, to remove the masking effects these payments can otherwise create. The graph shows farmers’ revenues and net incomes from the markets.

The green-shaded area highlights periods of positive net farm income; the red-shaded area marks negative net income periods. Most important, however, is the area shaded blue—the area between the gross revenue and net income lines. That area represents farmers’ expenses: the amounts they pay to input manufacturers (Monsanto, Agrium, Deere, Shell, etc.) and service providers (banks, accountants, etc.). Note how the blue area has expanded over time to consume almost all of farmers’ revenues, forcing Canadian net farm income lower and lower.

In the 23 years from 1985 to 2007, inclusive, the dominant agribusiness input suppliers and service providers captured 100 percent of Canadian farm revenues—100 percent! During that period, all of farm families’ household incomes had to come from off-farm employment, taxpayer-funded farm-support programs, asset sales and depreciation, and borrowed money. During that time, farmers produced and sold $870 billion worth of farm products, but expenses (i.e., amounts captured by input manufacturers and service providers) consumed the entire amount.

Bringing these calculations up to date, in the 32-year period from 1985 to 2016, inclusive, agribusiness corporations captured 98 percent of farmers’ revenues—$1.32 trillion out of $1.35 trillion in revenues. These globally dominant transnational corporations have made themselves the primary beneficiaries of the vast food wealth produced on Canadian farms. These companies have extracted almost all the value in the “value chain.” They have left Canadian taxpayers to backfill farm incomes (approximately $100 billion have been transferred to farmers since 1985). And they have left farmers to borrow the rest (farm debt is at a record high–just under $100 billion). The massive extraction of wealth by some of the world’s most powerful corporations is the cause of an ongoing farm income crisis.

To leave a comment, click on the graph or this post’s title and then scroll down.

Graph sources: Statistics Canada, CANSIM matrices, and Statistics Canada, Agricultural Economic Statistics, Catalogue No. 21-603-XPE

Yes there is to much talk about Gross Farm Income and not enough talk about net farm income.

Farmers need to cooperate much more to battle unfair practices.

Private Seed Dealers and our Farmer owned Coop’s sell seed but are told what terms to apply and are trapped into being the front line sales team for these large seed and chemical companies that take advantage of farmers.

Farmers could do much more to re-balance our costs and to boost our income by working together for better bargain.

Seed costs have increased for canola while most of any yield advantage is due to better seed placement, a bit of costly insect and disease control and fertilizer. Canola seed breeding for yield has to account that the parent varieties of many hybrids now (which would have yielded quite well) were made with Public Research Dollars. …Indeed Canola would not exist if it were not for the Public Funded effort which found Canola. But presently high farmer cost canola seed includes a huge Legislated owner right to charge for share holder profit and an excuse that some of this money is to search for new canola varieties–presumably for again higher cost to the farmer.

A lot of hybrids in canola are sold, this makes it impossible to save seed to use for the next year, causing a farmer more expense. The seed treatment for disease and for insects is very difficult to purchase separately from the seed so the farmer could treat saved seed.

The glossy advertising from seed companies each year is paid by last years seed cost.

There are many places which do not quote a set price for canola seed or crop inputs. The new trick is to offer rebates if you buy this or that connected product AND if you buy volume you might get a larger discount. So it is very difficult to budget and know our costs with all these rebates and sales games.

There are many tricks of sales departments that contribute to farmers low net income.

ilrobson@xplornet.ca

Alarming, to say the least. Where did you get the information?

Thanks, Paul. Data is from Stats. Can. CANSIM databases, esp. 002-0001, 002-0014, 002-0009, and 002-0076. If you want to recreate it, I can give you more details.

We must share the hell out of this and take it to agriculture and marketing meetings of all types. Share with friends and MP’s & MLA’s. Buy local, create local land-banks for new/young farmers.

Thanks, David. I agree. We need to change the conversation and strengthen farmer-supportive institutions.

Great work. Keep it up.

Thanks, Haroon.

Another instance of the great work that we’ve become accustomed to getting from outstanding scholar and activist for the commons and mother earth, Darrin Qualman. Now the real question is – how can we do with this finding what others have done with climate change data to produce a national and also global campaign on the lines of the Leap manifesto.

Thanks so much, Terisa. Your comments mean a lot to me. In a reply elsewhere, I noted that “the climate crisis creates an opportunity. To reduce emissions, farmers will have to use fewer inputs. Lower input use can reduce costs and increase net incomes. Thus, a side benefit of getting GHG emissions under control may be that farmers escape the control of Monsanto, Deere, Agrium, etc.” Thanks, again.

I don’t get it. This data at first glance makes it look like farmers are fools. No one forces them to buy all these agribusiness inputs, right? So why would they if it reduces their income? I imagine the answer might be that it doesn’t reduce their income. There are so many fewer farmers that the income shown in green, while less overall, is still higher on a per farmer basis? So what is the take-away in that case?

Dieter, you raise good points. Farmers aren’t fools. To some extent they’re trapped (though in a trap from which the could extricate themselves). Partly, it’s an issue of the whole being less than the sum of the parts. Each individual farm input promises, and seems to deliver, added profit. Fertilizers boost yields and, seemingly, profits. Chemicals do the same. So do high-tech seeds. But, perversely, the sum total of all these profit-boosting inputs is a loss. Non-farmers can see this in their own lives, though in a different but possibly analogous context. We fill our houses with labour- and time-saving appliances–washing machines, microwaves, even cars. Each promises to free up time. But many of us have little free time. The effect of the entire system–whether it be a modern lifestyle or an input-overdependent farm–cannot easily be deduced by looking at individual technologies or inputs in isolation. We have failed to take a systematic, civilization-scale look at our food system. Our farmers are suffering as a result.

Hi Darrin – I really like your answer to Dieter. Our obsession with ‘efficiency” has not delivered a meaningful quality of life for anyone it seems. We are always looking for better but perhaps not asking the “whys” of what motivates us, believing instead that we will be left behind if we don’t conform and want what others have. No time left to enjoy the moment and be grateful just to be. Farmers are people just like anyone, no better no worse. It takes an exceptional person, no matter what their situation to stand against the tide.

Thanks, Ruthie. Efficiency is indeed the problem. One of the points I’m trying to make with my many graphs is that we are doubling and redoubling our use of energy and materials (and our outputs of wastes and atmospheric emissions). Despite this, we continue to claim that we are becoming ever more efficient. Efficiency is a concept of very dubious value.

“Efficiency is a concept of very dubious value”

Really?

Having lowered our farm’s costs of production isn’t of value? If we hadn’t done that over the years we’d have been run out of business long ago.

Thanks, for weighing in, Banachek. I’ll give an example of how slippery a concept “efficiency” is. Say I drive the most fuel efficient car available–a Prius or small Honda. That car is efficient. But what if I use that 1000kg car to move my 90kg body a kilometre to purchase 100 grams of donuts that I don’t need and will contribute to obesity and maybe diabetes? Was that trip efficient? It’s a means/ends problem. It’s not enough to know that our means are efficient, we have to think about ends. We currently through away 40 percent of our food. Your tractor may or may not be efficient, but the efficiency of that tractor tells us little about the efficiency of our food system as a whole. It is wholly possible to use efficient means to do inefficient things, un-needed things, or the wrong things. That’s a bit of what I meant by: “Efficiency is a concept of very dubious value.”

My question is fixed costs. Specifically real estate interest, taxes, and real estate rent. How much of the costs does this represent? Any?

Thanks for the question, Pat. Farmland purchase costs are not include as expenses (and land sales are not included as income). Interest payments on land are included. Taxes are and rent is. Stats. Can. CANSIM – 002-0005 can give you a detailed idea of farm expenses.