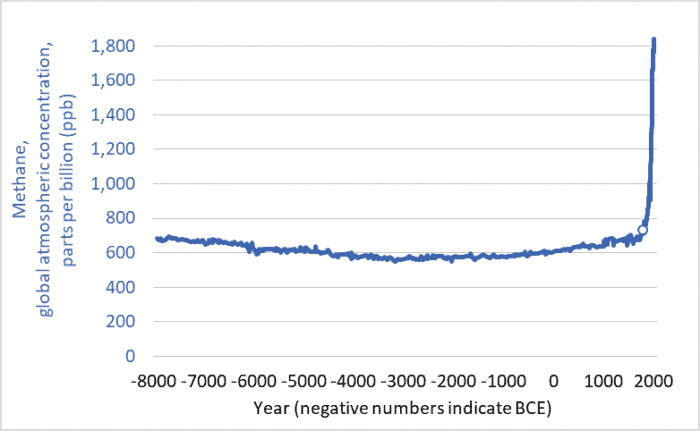

The graph above shows methane concentrations in Earth’s atmosphere over the past 10,000+ years: 8000 BCE to 2018 CE. The units are parts per billion (ppb). The year 1800 is marked with a circle.

Note the ominous spike. As a result of increasing human-caused emissions, atmospheric methane levels today are two-and-a-half times higher than in 1800. After thousands of years of relatively stable concentrations, we have driven the trendline to near-vertical.

Here are 10 things you should know about methane and the climate:

1. Methane (CH4) is one of the three main greenhouse gases, along with carbon dioxide (CO2) and nitrous oxide (N2O).

2. Methane is responsible for roughly 20% of warming, while carbon dioxide is responsible for roughly 70%, and nitrous oxide the remaining 10%.

3. Methane is a powerful greenhouse gas (GHG). Pound for pound, it is 28 times more effective at trapping heat than is carbon dioxide (when compared over a 100-year time horizon, and 84 times as effective at trapping heat when compared over 20 years). Though humans emit more carbon dioxide than methane, each tonne of the latter traps more heat.

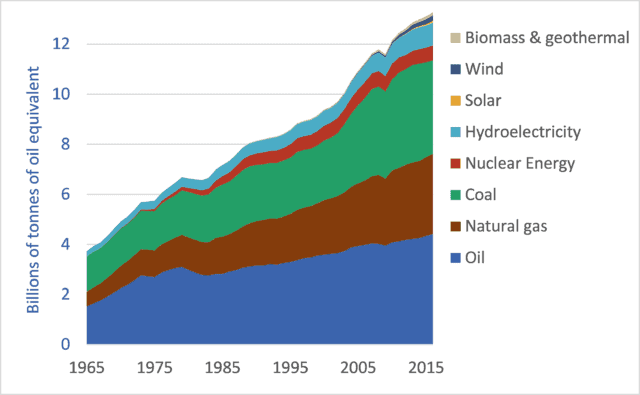

4. Fossil-fuel production is the largest single source. Natural gas is largely made up of methane (about 90%). When energy companies drill wells, “frac” wells, and pump natural gas through vast distribution networks some of that methane escapes. (In the US alone, there are 500,000 natural gas wells, more than 3 million kilometers of pipes, and millions of valves, fittings, and compressors; see reports here and here.) Oil and coal production also release methane—often vented into the atmosphere from coal mines and oil wells. Fossil-fuel production is responsible for about 19% of total (human-caused and natural) methane emissions. (An excellent article by Saunois et al. is the source for this percentage and many other facts in this blog post.) In Canada, policies to reduce energy-sector methane emissions by 40 percent will be phased in over the next seven years, but implementation of those policies has been repeatedly delayed.

5. Too much leakage makes electricity produced using natural gas as climate-damaging as electricity from coal. One report found that for natural gas to have lower overall emissions than coal the leakage rate would have to be below 3.2%. A recent study estimates leakage in the US at 2.3%. Rates in Russia, which supplies much of the gas for the EU, are even higher. Until we reduce leakage rates, the advantage of shutting down coal-fired power plants and replacing them with natural gas generation will remain much more modest than often claimed.

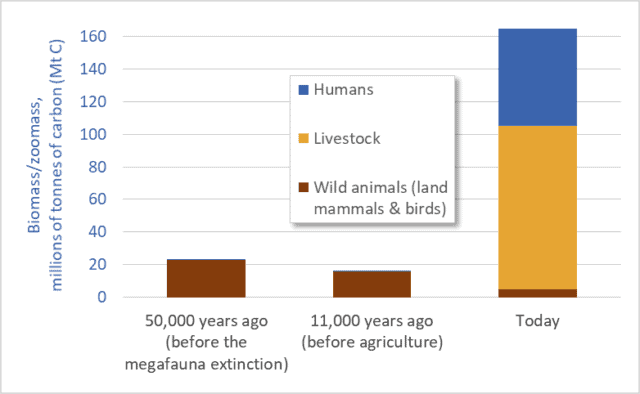

6. Domestic livestock are the next largest source of methane. Cattle, sheep, and other livestock that graze on grass emit methane from their stomachs through their mouths. This methane is produced by the symbiotic bacteria that live in the guts of these “ruminants” and enable them to digest grass and hay. In addition, manure stored in liquid form also emits methane. Livestock and manure are responsible for roughly 18% of total methane emissions.

7. Rice paddy agriculture, decomposing organic matter in landfills, and biomass burning also contribute to methane emissions. Overall, human-caused emissions make up about 60% of the total. And natural sources (wetlands, swamps, wild ruminants, etc.) contribute the remaining 40%.

8. There is lots of uncertainty about emissions. Fossil fuel production and livestock may be responsible for larger quantities than is generally acknowledged. The rise in atmospheric concentrations is precisely documented, but the relative balance between sources and sinks and the relative contribution of each source is not precisely known.

9. There is a lot of potential methane out there, and we risk releasing it. Most of the increase in emissions in recent centuries has come from human systems (fossil fuel, livestock, and rice production; and landfills). Emissions from natural systems (swamps and wetlands, etc.) have not increased by nearly as much. But that can change. If human actions continue to cause the planet to warm, natural methane emissions will rise as permafrost thaws. (Permafrost contains huge quantities of organic material, and when that material thaws and decomposes in wet conditions micro-organisms can turn it into methane.) Any such release of methane will cause more warming which can thaw more permafrost and release more methane which will cause more warming—a positive feedback.

Moreover, oceans, or more specifically their continental shelves, contain vast quantities of methane in the form of “methane hydrates” or “clathrates”—ice structures that hold methane stable so long as the temperature remains cold enough. But heat up the coastal oceans and some of that methane could begin to bubble up to the surface. And there are huge amounts of methane contained in those hydrates—the equivalent of more than 1,000 years of human-caused emissions. We risk setting off the “methane bomb“—a runaway warming scenario that could raise global temperatures many degrees and catastrophically damage the biosphere and human civilization.

Admittedly, the methane bomb scenario is unlikely to come to pass. While some scientists are extremely concerned, a larger number downplay or dismiss it. Nonetheless a runaway positive feedback involving methane represents a low-probability but massive-impact risk; our day-to-day actions are creating a small risk of destroying all of civilization and most life on Earth.

10. We can easily reduce atmospheric methane concentrations and attendant warming; this is the good news. Methane is not like CO2, which stays in the atmosphere for centuries. No, methane is a “short-lived” gas. On average, it stays in the atmosphere for less than ten years. Many natural processes work to strip it out of the air. Currently, human and natural sources emit about 558 million tonnes of methane per year, and natural processes in the atmosphere and soils remove all but 10 million tonnes. (again, see Saunois et al.) Despite our huge increase in methane production, sources and sinks are not that far out of balance. Therefore, if we stop increasing our emissions then atmospheric concentrations could begin to fall. We might see significant declines in just decades. This isn’t the case for CO2, which will stay in the atmosphere for centuries. But with methane, we have a real chance of reducing atmospheric levels and, as we do so, moderating warming and slowing climate change.

A series of policies focused on minimizing emissions from the fossil-fuel sector (banning venting and minimizing leaks from drilling and fracking and from pipes) could bring the rate of methane creation below the rate of removal and cause atmospheric levels to fall. A more rational approach to meat production (including curbing over-consumption in North America and elsewhere) could further reduce emissions. This is very promising news. Methane reduction represents a “low-hanging fruit” when it comes to moderating climate change.

The methane problem is the climate problem in microcosm. There are some relatively simple, affordable steps we can take now that will make a positive difference. But, if we don’t act fast, aggressively, and effectively, we risk unleashing a whole range of effects that will swiftly move our climate into chaos and deprive humans of the possibility of limiting warming to manageable levels. We can act to create some good news today, or we can suffer a world of bad news tomorrow.

Graph sources:

– United States Environmental Protection Agency (US EPA), “Climate Change Indicators: Atmospheric Concentrations of Greenhouse Gases.“

– Commonwealth Scientific and Industrial Research Organisation (CSIRO), “Latest Cape Grim Greenhouse Gas Data.“

– National Oceanic and Atmospheric Administration (NOAA), Earth System Research Laboratory, Global Monitoring Division, “Trends in Atmospheric Methane.“