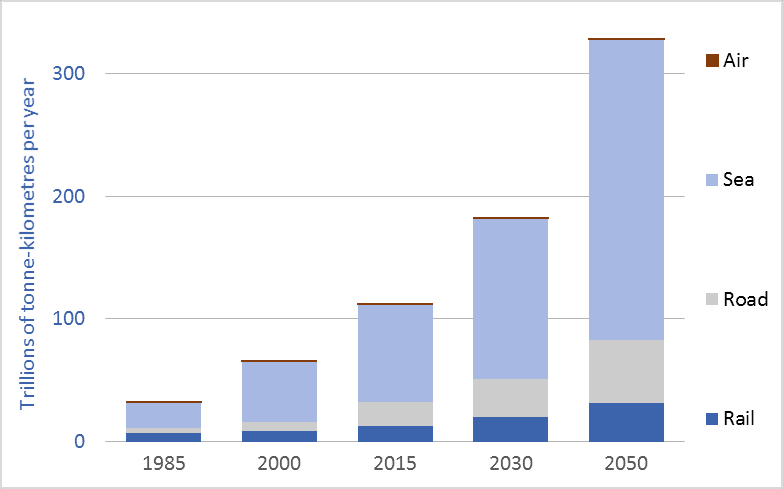

Global freight transport now exceeds 122 trillion tonne-kilometres* per year. That enormous tonnage/distance has more than tripled since the beginning of the “free trade” era, in the 1980s. And the Organization for Economic Cooperation and Development (OECD) projects that global freight transport tonnage will triple again in the coming generation—rising to 330 trillion tonne-kilometres per year by 2050 (see OECD). To put these trillions into perspective, freight movement will soon surpass 100,000 tonne-kilometres per capita per year for those of us living high-consumption lifestyles, here and around the world.

*Note: a tonne-kilometre is equivalent to moving one tonne one kilometre. If you move 10 tonnes 10 kilometres, that is 100 tonne-kilometres.

A major part of this increase in transport tonnage is related to trade agreements and globalization. As we’ve restructured the global economy we have off-shored our factories. Our washing machines, toasters, rubber boots, TVs, and many of our cars now come from half-way around the world. Our foods and fertilizers are increasingly shipped across continents or oceans. And we ship food, resources, and other goods around the world. Economic growth means we’re consuming more and more; globalization means we’re consuming resources and products from further away. These two trends, together, help explain the tenfold increase in global freight transport depicted in the graph.

Moving this colossal tonnage requires ships, trains, trucks, and airplanes—all of which burn fossil fuels and emit greenhouse gas (GHG) emissions. Emissions from the freight transport sector make up about 10 percent of all man-made CO2 emissions (see OECD). The OECD predicts that if current trends and policies hold, emissions will nearly double by 2050, to 5.7 billion tonnes of CO2 per year (see OECD). This near-doubling of freight transport emissions between now and 2050 will occur at the same time that we are attempting to cut overall GHG emissions by half. It is time to ask the obvious questions: Is our ongoing drive toward globalization (i.e., de-localization and transport maximization) compatible with our emission-reduction commitments and a livable climate? Indeed, as our leaders aggressively sign and implement still more “free trade” agreements (TPP, CETA, etc.) we should consider that perhaps doubling down on globalization vetoes emissions reduction, vetoes a stable climate, vetoes local food, and vetoes local jobs.

To leave a comment, click on the graph or this post’s title and then scroll down.

Graph sources: 2015, 2030, and 2050 data from the OECD/ITF page 56. Data for 2000 and 1985 are from various sources: air freight data is from the World Bank. Rail freight data is from the World Bank. Maritime freight data is from the United Nations, Review of Maritime Transport. Road freight data for 2000 is from the OECD. Road freight data for 1985 is an informed estimate.